For the first time in its history, Polymarket has listed Major League Pickleball on its predictions market. But putting your money on the line still comes with a catch.

United Pickleball Association (UPA) CEO, Connor Pardoe made a post on X that has the pickleball community intrigued:

Who will will the @MajorLeaguePB title!? Check it out on @Polymarket https://t.co/QZtqwZ4KPd

— Connor Pardoe (@connorpardoe_pb) August 12, 2025This poses the question: What is Polymarket and how is Major League Pickleball (MLP) involved?

What is Polymarket?

At its simplest, Polymarket is a prediction market where users trade “shares” on the outcome of future events — politics, sports, culture — using crypto or traditional currency.

Think of it as markets answering the question, “What does the crowd think will happen?” but with real money on the line.

Founded in 2020, the platform gained attention during election season when enormous volumes poured into Trump-related markets, turning Polymarket into both a data source and a lightning rod.

How are Polymarket and MLP involved?

For the first time in its history, Polymarket has listed Major League Pickleball on its platform.

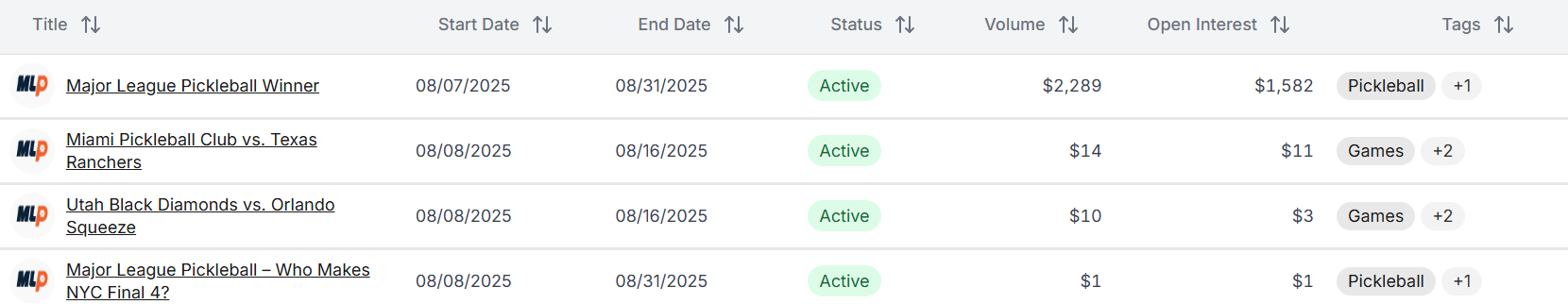

As of publishing, there are four future predictions that customers can choose from:

The four MLP Polymarket "markets" available on 8/12/25 Does Not reflect current positions in the marketplace

The four MLP Polymarket "markets" available on 8/12/25 Does Not reflect current positions in the marketplaceAs you can see, over $2,000 worth of trades have been made thus far. Let's take a look at the "Major League Pickleball Winner".

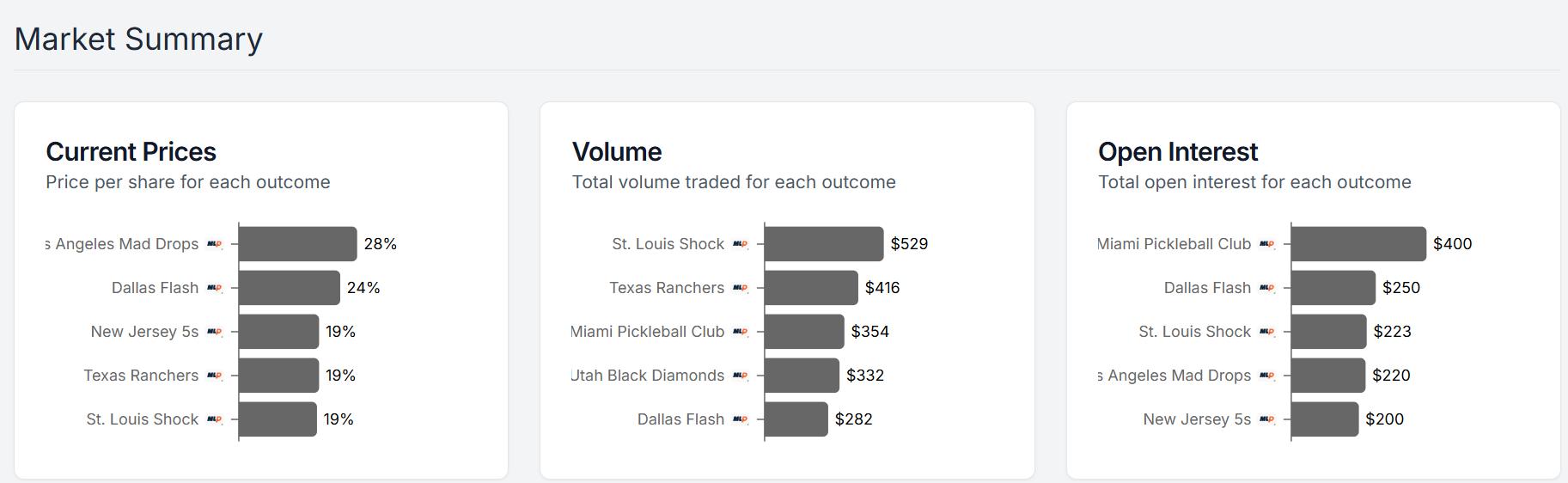

Data as of 8/12/25 and does not reflect updated information

Data as of 8/12/25 and does not reflect updated informationThe St. Louis Shock have the most action to win it all, but the cost for purchasing shares in the LA Mad Drops is the highest right now. All very intriguing stuff.

US-based traders

It is important to note, transactions on Polymarket are not known as "bets." They are trades based on buying and selling of shares representing the likelihood of a future event occurring.

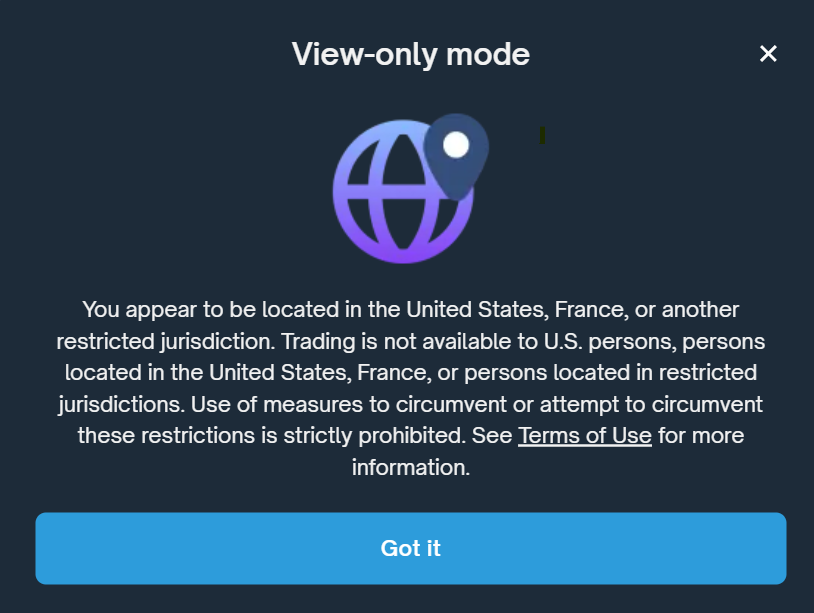

Unfortunately for interested parties in the United States, as of publishing, trading on the Polymarket is currently not allowed. The following error is given if someone in the United States attempts to make a transaction in the marketplace:

For now, it is fascinating for United States based traders/investors to view the Polymarket rise and fall of predictions for MLP teams, but citizens (even abroad) cannot partake just yet.

A request to understand when exactly Polymarket will be available in the United States was not immediately answered by the company's press team, but if one is received, this article will be updated with relevant information.

Polymarket has already entered the pickleball social media spheres, where it looks like a ton of people are interested.

Zane Navratil posted a thread on X:

1/6 Gambling is finally here in pickleball….well…kind of. You can take a financial position through the Polygon blockchain network and trade shares that represent the likelihood of specific outcomes occurring.

— Zane Navratil (@ZaneNavratil) August 12, 2025Even Major League Pickleball made an X post:

Who will be the Major League Pickleball’s Winner 🏆 in 2025? Check it out now on @Polymarket @PolymarketSport ⬇️ https://t.co/PXnvMYJaVm

— Major League Pickleball (@MajorLeaguePB) August 12, 2025Brief history of Polymarket

Polymarket’s comeback tour looks less like a long-shot rally and more like a carefully drawn double-fault correction (I hope you enjoy the tennis reference).

The crypto-native prediction market that exploded into the U.S. public eye during the 2024 election — and then promptly found itself in the crosshairs of federal regulators — appears to have found a legal route back onto American soil. But make no mistake: The path here has been equal parts hustle and regulatory chess.

The run-in with regulators isn’t new. In January 2022, the Commodity Futures Trading Commission reportedly hit Polymarket (then doing business as Blockratize) with a cease-and-desist and a $1.4 million penalty for operating unregistered event-based binary options — a settlement that effectively forced Polymarket to block U.S. users from on-shore trading unless and until it complied with U.S. law. That was the first serious legal leash.

Fast-forward to late 2024: as Polymarket’s election books swelled, federal scrutiny intensified. Law enforcement executed a search warrant at CEO Shayne Coplan’s residence, and federal prosecutors opened an inquiry into whether the company allowed U.S. bettors to transact in violation of the 2022 agreement. The headlines were dramatic; the questions were existential.

New changes could mean Polymarket is on its way back to the United States

In July 2025, Polymarket announced — and press outlets confirmed — a $112 million acquisition of QCEX (QCX and its clearing arm), a small derivatives exchange and clearinghouse with a Commodity Futures Trading Commission (CFTC) license.

That purchase gives Polymarket a regulated entity inside the U.S. plumbing: an exchange and clearinghouse already in the CFTC’s orbit. Almost immediately afterward, federal probes tied to the platform were reported closed, removing a major legal overhang. In short, Polymarket bought an already functioning exchange to meet the requirements of the CFTC.

Will Polymarket be legal in the U.S., and when? Let’s be blunt: “legal” isn’t a simple on/off switch. With QCEX’s CFTC authorization and the formal end of the investigations, Polymarket has done the two things regulators prize — submit to supervision and remove outstanding enforcement risk.

Barring unexpected enforcement reversals or fresh state-level challenges, the company looks positioned to re-onboard U.S. customers on a regulated footing within months, not years.

For bettors, journalists, and market watchers, Polymarket’s return will be worth watching: it promises liquid, fast-moving odds on public events — and a fresh test of how prediction markets can operate under American rules.

If Polymarket succeeds, it won’t be because the tech won; it’ll be because the company learned to play by the referees’ rulebook.

Stay updated with all news related to pickleball by following The Dink on all socials, and subscribing to the Newsletter. This author is very excited about Polymarket offering markets related to Major League Pickleball, and as soon as it is available in the US, you better believe we will let you know ASAP.

(Reporting draws on CFTC releases and coverage from Bloomberg, Financial Times, Investopedia and other outlets.)

Anuncie Aqui / Advertise Here

Sua marca para o mundo Pickleball! / Your brand for the Pickleball world!

English

English  Spanish

Spanish  Portuguese

Portuguese  German

German  Italian

Italian  Japanese

Japanese  French

French  Polish

Polish  Russian

Russian  Netherlands

Netherlands  Hungarian

Hungarian  Turkish

Turkish  Videos

Videos

English (US) ·

English (US) ·  Portuguese (BR) ·

Portuguese (BR) ·